The soybean production in South America and the United States continues to grow at record levelsbut the increase in supply does not translate into better prospects for the Argentina. Experts warned that biofuel policies in Brazil and the United States are generating a surplus of soybean meal that threatens Argentine leadership in this segment, which for the country would represent revenues 10,496 million dollars at the end of 2024and it is estimated that in 2025 could be located, in 9898 millionalthough with growing challenges.

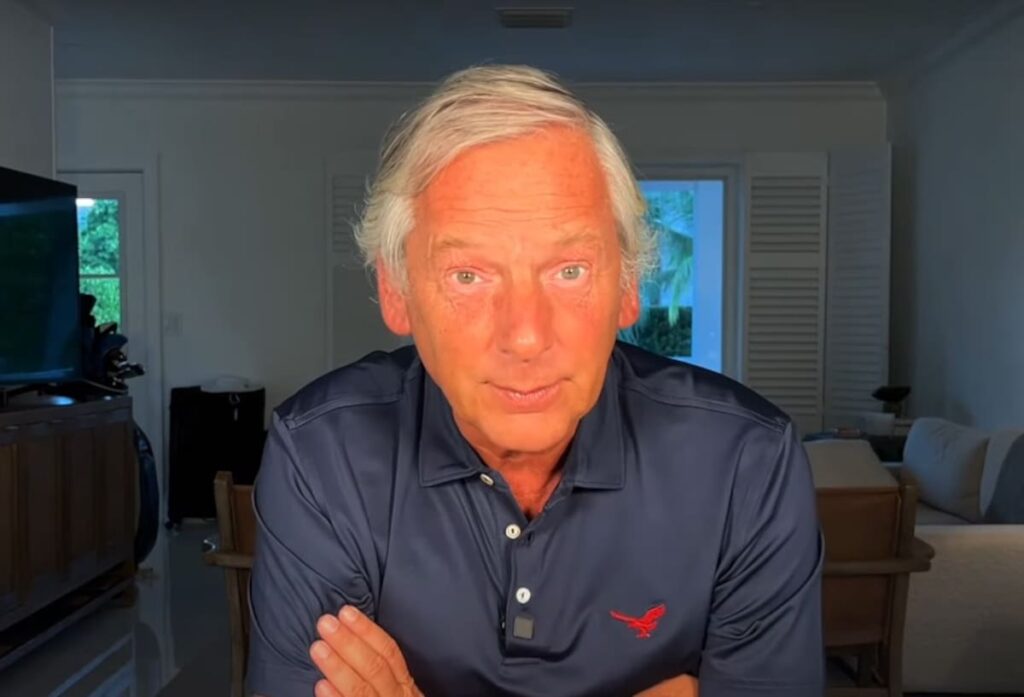

”Argentine politics should understand that our main export cluster, soybeans, is under threat”said Javier Preciado Patiño, from RIA Consultores and former undersecretary of Agricultural Markets. In that sense, he explained that both Brazil and the United States, through their biofuel policies, are driving greater demand for soybean oil, “which generates surplus flour that must be exported”. He highlighted that “the soybean flour market is relatively small compared to the bean market, which facilitates its saturation”. Both countries are dumping increasingly larger quantities into the international market, which poses a structural problem for Argentina. This challenge will not only impact the current campaign, but could also extend over time, affecting the competitiveness of the country in the segmenthe warned.

Added to this situation is that This year, with the increase in production, demand did not keep up with the growth in supply and this will already be reflected in the fall in prices. Strictly speaking, the projections for the 2024/25 campaign point to a record soybean production worldwide. According to the United States Department of Agriculture (USDA), global production would reach 427.1 million tonsand 8.2% more than in the previous campaign. In South America, Brazil will lead with growth of 10.5%reaching the 169 million tonswith a potential of 180 million if weather conditions are favorable. Meanwhile, for Argentina it projects an increase in 7.9%to 52 million tons.

Faced with this situation, Preciado Patiño highlighted the need for Argentina to take measures to protect the country’s main export complex. “To sustain our leadership, we need two key measures: the reduction of export duties and the increase in the mandatory cut-off with biodiesel”. This would allow us to replicate the strategy of Brazil and the United States, which increase the use of biofuels, They withdraw supply from the global market and, in some way, subsidize the export of soybean meal.

Currently, in Argentina the mandatory cuts are 7.5% for biodiesel that comes from soybean oil and 12% for corn bioethanol. These figures are far from the most aggressive policies of other countries.

In the United States, currently, approximately half of the inputs to make renewable diesel come from used cooking oil imported mainly from China and other Asian countries. There is strong pressure from the governors of the region of the Midwest and US legislators for the new administration to ban the import of this recycled oil and replace it with locally produced soybean and rapeseed oil.

He said Trump’s policy could align with these demands. “It is likely that the import of these materials will be restricted and the use of vegetable oils derived from domestic crops will be promoted”he pointed out. This, he commented, could leave greater exportable surpluses of soybean meal in the global market, affecting Argentina even more.

Along these lines, the Rosario Stock Exchange had warned a few months ago that for Argentina “The main threat is the growth of soybean processing in Brazil and the United States, which do not absorb all the flour produced in their domestic markets”. Between 2013/14 and 2023/24, both countries increased their production by more than 12 million tonsallocating Brazil the 50% of that increase to exports and the United States 30%. In that sense, the entity warned: “With the prospects that both countries will continue to increase their cut for biofuels and demand more soybean oil, it is feasible that the crush of soybeans and increases competition to place surplus soybean flour on the international market”.

Gustavo López, market analyst, He highlighted that the Argentine oil industry faces difficulties due to lack of supply, competitiveness problems and the refusal of some producers to sell. This while Brazil and the United States are advancing at a much faster pace with this policy of using their soybean oil for biofuels, something that he indicated, like Patiño, can “generate a surplus of soybean meal that, although it is not immediately noticeable, will end up affecting the global market.”

López said that, although Argentina continues to be the leader in the export of soy flour, it has lost some points in its global participation, going from 40% to 38%. However, it remains a key player in this segment. According to the analyst, the problem lies in the fact that competing countries, especially the United States, are increasing their milling capacity by building new plants, which allows them to generate more oil for biodiesel and more flour that will eventually be exported.

“The Americans had planned 18 new plants; Although not all of them are enabled, some are, which allows them to grind more, generate more oil for biodiesel and produce more flour that they send to the market,” he explained. López also mentioned that Brazil is following a similar strategy, which could further complicate the situation for Argentina in the near future.

Carlos Pouiller, market analyst at AZ-Group, He pointed out that incentives for the production and milling of oilseeds, in this case soybeans for biofuels, have been in place for some time, and highlighted that this could be a problem in the future. However, he highlighted that at this time what “most harms” Argentina is the situation of low international prices for both soybeans and flour and oil. “Globally, grain supply has increased by almost 30 million tons compared to the previous cycle, but demand is not enough to absorb this production. This has led to a significant increase in stocks, creating a saturated market. This situation is clearly reflected in the downward trend in prices that we have observed in recent weeks.”

Along these lines, Pouiller also indicated that, with Trump’s victory, one of the possibilities is that if the United States cancels the policies to stimulate biofuel production, the price of soybean oil could fall even further.

Workout

Workout

Meditation

Meditation

Contact Us

Contact Us