Contrary to what has happened in recent times, 2025 will possibly be the year of change in relation to supply and demand in the real estate business. This was one of the many conclusions reached by different actors who participated in the panel that took place in the second edition of the event. Home Bank organized by the Mortgage bank.

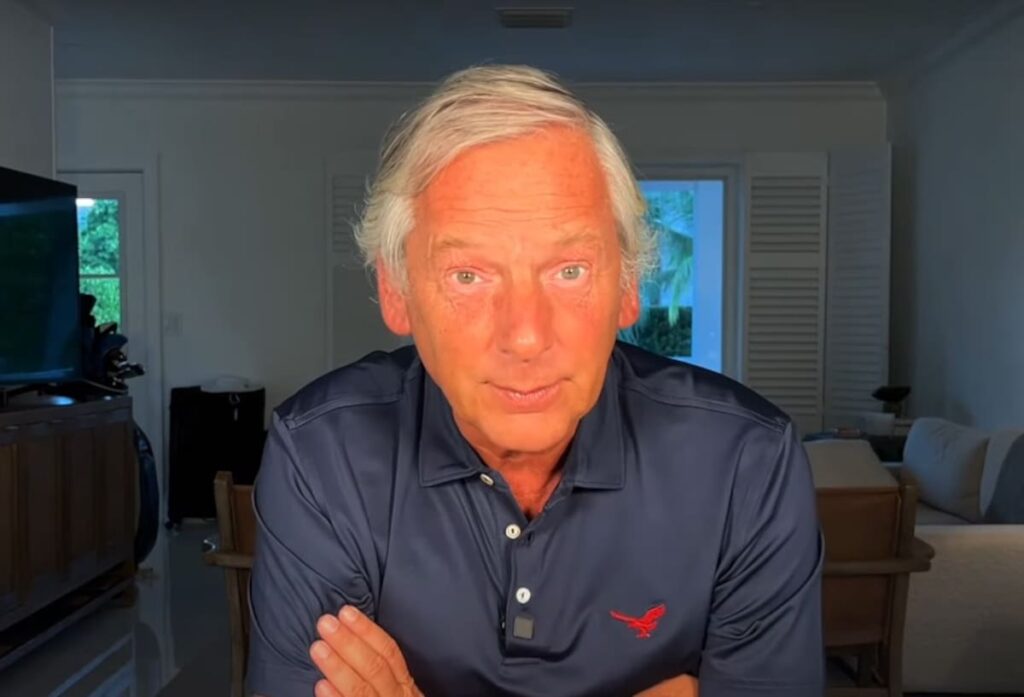

At the pace of current events, Jorge Cruces, Investment Director of IRSA; Santiago Tarasido, CEO of the construction company Criba and head of the Association of Housing Entrepreneurs (AEV); Conrado Isla, president of Carlos Isla, a firm dedicated to the distribution of materials, and Alejandro Renghini, CEO of Ilva, dedicated to the production of porcelain tile, began the talk by referring to the creditwhich led to all the protagonists explaining how this instrument particularly affected and affects its segment.

Thus, the IRSA manager started the panel announcing the takeoff of the residential market after “15 years of a market focused on investor demand”. According to Cruces, both the bleach and how the possible financing “makes there is more demand”, which forces prices rise. “It was the time for small units, now it is time for another type of product, which is not in stock, and for us it is a great opportunity,” he explained the reason why the company will advance a US$2 billion investment plan. in residential real estate projects.

Santiago Tarasido, from Criba, recognized that this “It was not an easy year, beyond today’s photo. With falling inflation, after many years of tremendous inoperability, possibilities are opening up. In 2025 we must be calm, but there are conditions that indicate that they are on the right path”.

In his role as head of the AEV, he explained that the issue of housing “is a problem that we saw and we could not find a solution, we were tired of looking for proposals and bringing together ideas and in the context in which we had been working it was almost impossible to propose anything. Now, thinking about a market with credit where it will be built for the people who need it and not just for the investor is good news.”

Efficiency time

Alejandro Renghini, from ILVA -specialized in pocelanato-, agreed that the year to come is a year in which “good prospects are seen”; a 2025 that, he explained, will find the company making an investment of US$30 million in a new plant. “But beyond that, we will have to reinvent ourselves with the efficiency of the production system, since we come from years with little competitiveness.”

As he estimated, “Now comes the time to generate service”since, it foreseesthere will be a different stabilityno spikes. In this context, he stressed, the challenge will be to reinvent ourselves to be competitive internally and also from the region.

“Until the end of last year, distribution was focused on maintaining stock, to supply the chain and sustain the inefficiencies that were going to occur due to the lack of inputs. This year the focus will be much more on connectivity”said Conrado Isla from the construction materials distribution company, thus pointing out how the macro scenario impacted the company and its activity.

In the same sense, he highlighted what the new economic framework will bring: “Before, we sold to the client because we had stock or because we provided a hedging tool in the face of the macro instability that existed, because people did not know how much they were going to pay. “The materials would be ready tomorrow and he used us as a coverage tool.”

“Today I believe that it will not continue to be like this,” said the businessman before continuing: “Now people are going to make their money count through financial tools and the focus is going to be on efficiency, service and added value that we can give. I think that The local industry is going to have to become more competitive because an opening process is coming. And distribution is also going to have to become more efficient.”

Context & prices

The power that the consumer has gained in the current scenario was the next topic of the talk. Tarasido maintained that, on time, decision and power have been transferred to him. “Until now, in an economy with no alternative and high inflation, the one who had the decision was the one who had the stock. Today having stock is not an advantage. There is an important paradigm shift there.”.

According to the CEO of the construction company, 2024 was a year with a large increase in costs that poses another challenge in addition to those exposed: how to ensure that these increases are transferred to priceswhich will inevitably involve the entire construction segment due to the simple replacement cost.

“There it has to be accompanied by the issue of the purchasing power of the salary rather than the possibility of credit or purchasing at better prices,” Tarasido continued, adding an extra component: the comparison of values with other cities in the region. “We were too low and it was unsustainable, both construction costs and unit sales prices. It was not logical that well-located units in good locations would be cheaper than other cities in the region with what Buenos Aires means,” he emphasized.

Jorge Cruces contributed his developer’s perspective, warning that In 2025, stock prices will continue to rise, especially for new meters. In that sense, he referred to the honesty of values, highlighting that, in addition, there was a inflation in the world regarding construction costs of which Argentina was not immune.

Tax burdens and formalization

“But, later, mortgage credit will formalize the industry. The next step is to review the tax burden. Today, depending on the province, it represents between 45% and 55% of the tax burden. an unpleasant number”Cruces continued, in relation to what is coming and the market responses.

Along these lines, Tarasido completed: “We carried out a study based on data from the Chamber of Construction that showed that only in relation to gross income how does it affect a real estate development in a chain with an impact of 2.5% to 3% that It applies to all inputs. It is a point that, for example, does not exist in Uruguay.”

As he explained, Today there is no chance to pass on the increased cost to the price.What could happen next year, “with better access to credit and better purchasing power.” So yes, Isla estimated, it could be transferred if functional units are sold with an increase in the sales receipt. “Today prices have not increased and costs have increased,” he defined.

imminent future

Renghini added predictions about what will happen in the coming months, always in contrast to the present. Thus, he pointed out that Argentina is one of the few countries where having stock is considered when in the rest of the world it is the other way around.: “The less stock you need to be able to function, the more efficient you are. However here, for the replacement, you are obliged. All the suppliers that have to do with porcelain work in a way that always buys in the future and I think that that is going to end up disappearing,” he predicted.

For his part, Tarasido also predicted changes regarding construction. “Today you have the possibility of generating models and having the building built without it being built. And you already know exactly where the facilities, the pipes, the structure pass through… And to this you add a production capacity that you did not have 20 years ago,” he described.

Likewise, indicated the head of Criba, there is a tendency to build off site, that is, off site, and less in the workplace, which implies a “very important” change of matrix in production, in addition to a lot of advantages -from safety to the possibility of working in the rain-, but also challenges such as greater integration in a value chain that, according to the CEO of the construction company, is very dispersed.

Cruces also referred to what is to come; punctually in the residential market. “The demand in Argentina, depending on the real salary and the mortgage loan, is infinite at this moment“, he shot, exemplifying that many couples and young families need housing and that if a way is found for them to pay for it, the demand responds.

“That is what is happening currently. We are seeing it. In other words, the entire market is seeing that The demand is there as long as people can pay it.. Today, our stock is one and two rooms. That is to say with three, four bedrooms, there is a lot to build within 10 years”, he concluded.

Workout

Workout

Meditation

Meditation

Contact Us

Contact Us